Mergers and acquisitions are becoming more and more common as entities aim to achieve their growth objectives. IFRS 3 ‘Business Combinations’ contains the requirements for these transactions, which are challenging in practice.

Our ‘Insights into IFRS 3’ series summarizes the key areas of the Standard, highlighting aspects that are more difficult to interpret and revisiting the most relevant features that could impact your business.

In order to determine if the guidance of IFRS 3 should be applied to the acquisition of an asset or a group of assets, an entity should first identify if the asset or group of assets acquired represents a business combination. If the entity concludes it is a business combination, it should then ensure the business combination transaction falls within the scope of IFRS 3. This article sets out how an entity should determine if the transaction is a business combination, and whether it is within the scope of IFRS 3. This article should be read closely with our other ‘identification’ articles:

IFRS 3 refers to a ‘business combination’ rather than more commonly used phrases such as takeover, acquisition or merger because the objective is to encompass all the transactions in which an acquirer obtains control over an acquiree no matter how the transaction is structured. A business combination is defined as a transaction or other event in which an acquirer (an investor entity) obtains control of one or more businesses. An entity’s purchase of a controlling interest in another unrelated operating entity will usually be a business combination (see Example 1 on page 3). However, a business combination may be structured, and an entity may obtain control of that structure, in a variety of ways.

Therefore, identifying a business combination transaction requires the determination of whether:

If an entity acquires an interest in a business entity but does not obtain control, it should apply IAS 28 ‘Investments in Associates and Joint Ventures’, IFRS 11 ‘Joint Arrangements’ or IFRS 9 ‘Financial Instruments’, depending on the nature of the relationship that the interest creates and the level of influence the entity can exert over the investee’s financial and operating policies.

Entity T is a clothing manufacturer and has traded for a number of years. Entity T is deemed to be a business. On 1 January 2020, Entity A pays CU 2,000 to acquire 100% of the ordinary voting shares of Entity T. No other type of shares has been issued by Entity T. On the same day, the three main executive directors of Entity A take on the same roles in Entity T.

Entity A obtains control on 1 January 2020 by acquiring 100% of the voting rights. As Entity T is a business, this is a business combination in accordance with IFRS 3.

IFRS 3 requires the entity determine whether assets acquired, and any liabilities assumed constitute a business. If the assets and liabilities are not considered to be a business, then the transaction should be accounted for as an asset acquisition. IFRS 3 has detailed guidance on the definition of a business and this guidance has been considered in our separate article ‘Insights into IFRS 3 – Definition of a business (Amendments to IFRS 3)’. This publication presents only the guidance on the new definition of a business that was issued in October 2018, which should be applied to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after 1 January 2020 and to asset acquisitions that occur on or after the beginning of that period.

Business combination accounting does not apply to the acquisition of an asset or asset group that does not constitute a business. The distinction between a business combination and an asset acquisition is important as the accounting for an asset purchase differs from business combination accounting in several key respects, some of which are summarized below:

A business combination involves an entity obtaining control over one or more businesses (this entity is known as ‘the acquirer’). IFRS 10 ‘Consolidated Financial Statements’ and IFRS 3 provide guidance to determine whether an entity has obtained control. In most cases control of an investee is obtained through holding the majority of voting rights. Therefore, control is normally obtained through ownership of a majority of the shares that confer voting rights (or through obtaining additional voting rights resulting in majority ownership if some were already held). In transactions where an acquired business is not a separate legal entity (a trade and assets deal), control typically arises through ownership of those assets.

However, control can also be obtained through various other transactions and arrangements – some of which require careful analysis and judgement. The definition of control and relevant guidance issued by both the IASB and IFRIC should then be considered. As well as assessing whether control is obtained, this guidance is also relevant in addressing the related questions of when control transfers and which entity obtains control.

For more explanation on how to apply the definition of control, refer to our IFRS 10 guide entitled ‘Under control? A practical guide to applying IFRS 10 Consolidated Financial Statements’. If applying the guidance of IFRS 10 does not clearly indicate which of the combining entities is the acquirer, additional factors included within IFRS 3 should be considered. For instance, it is possible for control to be obtained:

The identification of an acquirer is discussed in more detail in a separate article. Refer to ‘Insights into IFRS 3 – Identifying the acquirer’.

An investor controls an investee when the investor is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee.

“The determination of whether an entity has obtained control is based on guidance in both IFRS 10 ‘Consolidated Financial Statements’ and IFRS 3.”

IFRS 3 applies to all business combinations identified as such under IFRS 3 with the following three exceptions:

There is no specific guidance in IFRS on how a joint arrangement should account for a business contribution which consists in the parties to the joint arrangement in contributing operating activities which satisfy the definition of businesses in exchange for equity instruments issued by the ‘joint arrangement structure’. Our view is that IFRS 3, by analogy, can be applied by the joint arrangement, even though the transaction is outside the mandatory scope of IFRS 3.

Alternative approaches may also be acceptable, such as the use of predecessor value method or application of fresh start accounting. Management should use their judgement and apply the requirements of IAS 8 ‘Accounting policies, changes in accounting estimates and errors’ to determine the most appropriate accounting policy to provide relevant and reliable information to users of the financial statements.

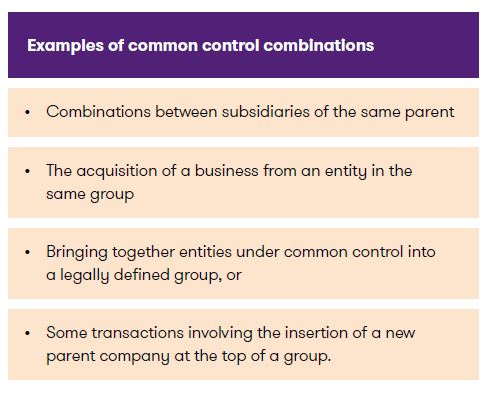

Business combinations involving common control frequently occur. Broadly, these are transactions in which an entity obtains control of a business (hence a business combination) but both combining parties are ultimately controlled by the same party, or parties, both before and after the combination and that control is not transitory. These combinations often occur as a result of a group reorganization in which control of subsidiaries changes at a certain level within a group as a result of reclassification of ownership interests between the members of the group, but where control by the ultimate parent remains the same over those subsidiaries.

Our separate article ‘Insights into IFRS 3 – Business combinations under common control’ provides more details on how to identify and account for these combinations.

“Of the three scoped-out transactions in IFRS 3, business combinations involving common control frequently occur.”

For the avoidance of doubt, IFRS 10 provides a limited scope exception from the consolidation guidance for a parent entity that meets the definition of an investment entity. Entities that meet the definition of an investment entity in accordance with IFRS 10, should not consolidate certain subsidiaries. Instead they are required to measure those investments that are controlling interests in another entity (ie their subsidiaries) at fair value through profit and loss. Therefore, any acquisition that involves an investment entity being the acquirer of an investment in a subsidiary is specifically excluded from the scope of IFRS 3. Refer to IFRS 10 guide ‘Under control? A practical guide to applying IFRS 10 Consolidated Financial Statements’ for more details.

At the time of writing the International Accounting Standards Board (IASB) is conducting a research project on business combinations under common control. The IASB has acknowledged that the absence of specific requirements has led to diversity in practice and has published a discussion paper in November 2020. The IASB is seeking views on the paper before 1 September 2021 and we will be submitting our views.